Getmyoffer Capitalone Com

Getmyoffer.Capitalone.com is the official site where you can respond to a Capital One pre-approved credit card offer. If you received a mailer with a reservation number, this secure platform lets you check your offer details, complete the application, and see if you qualify for a Capital One credit card.

Access Official Website here: Getmyoffer.Capitalone.com

Getmyoffer.Capitalone.com Reservation Code & Access Code

Are you trying to build your credit or seeking better rewards but tired of endless credit card rejections? If you’ve received a Capital One pre-approved credit card offer in the mail, you already have a huge advantage. This offer comes with a Capital One reservation code and access code, directing you to the official Capital One portal: Getmyoffer.Capitalone.com. It’s your fast track to exclusive credit card deals tailored to your credit history.

Capital One is one of the leading U.S. financial institutions, serving over 100 million customers and offering a variety of credit cards for all types of consumers, including students, small business owners, frequent travelers, and individuals working to rebuild credit.

In this complete 2025 guide, we’ll walk you through how to use your Getmyoffer.Capitalone.com codes, how to apply without one, what types of Capital One credit cards are available, and how to activate and manage your new card securely online.

Contents

- 1 Getmyoffer.Capitalone.com Reservation Code & Access Code

- 2 What Is Getmyoffer.Capitalone.com?

- 3 Why Is a Pre-Approved Offer Important?

- 4 How to Use Your Reservation & Access Code on Getmyoffer Capitalone Com

- 5 Where Can You Find Your Capital One Reservation and Access Codes?

- 6 What if I Can’t Find my Reservation Number and/or Access Code?

- 7 What If You Don’t Have a Code?

- 8 Types of Capital One Credit Cards Available in 2025

- 9 How to Activate Your Capital One Credit Card?

- 10 How to Set Up Online Account Access?

- 11 Security & Privacy at Getmyoffer.Capitalone.com

- 12 Expired or Invalid Code? What to Do

- 13 Pre-Approval vs Pre-Qualification: What’s the Difference?

- 14 Capital One Contact Information

- 15 Use Your Capital One Codes Wisely

What Is Getmyoffer.Capitalone.com?

Getmyoffer.Capitalone.com is the official Capital One portal designed for customers who receive pre-approved credit card offers in the mail or via email. These exclusive offers are generated based on your credit profile, purchasing history, and financial behavior from credit bureaus such as TransUnion, Experian, and Equifax.

When Capital One believes you meet the eligibility criteria for one of its products, it sends you a customized offer that includes:

- A 16-digit Capital One reservation code

- A 6-digit Capital One access code

By entering these codes into the portal, you unlock your personalized credit card offer, often including:

- Higher approval odds

- Lower interest rates (APR)

- No annual fees or waived first-year fees

- Customized reward structures

Why Is a Pre-Approved Offer Important?

Receiving a pre-approved credit card offer means that Capital One has already performed a soft inquiry (which does not impact your credit score) and determined you are highly likely to be approved. While final approval still depends on a hard inquiry and full credit assessment, your chances are significantly better than applying without pre-qualification.

Pre-approved offers also help you:

- Avoid unnecessary hard credit inquiries

- Get access to top-tier cards like Capital One Venture Rewards or Capital One Quicksilver Cash Rewards

- Gain insight into your creditworthiness

- Reduce paperwork and processing delays

How to Use Your Reservation & Access Code on Getmyoffer Capitalone Com

If you received a Capital One mailer or email with a reservation code and access code, here’s how to redeem your offer:

1. Go to the Official Website

Visit: https://getmyoffer.capitalone.com

2. Locate Your Codes

Find your:

- 16-digit reservation code

- 6-digit access code

These are usually printed on the bottom half of the letter or in the email body.

3. Enter the Codes

Input both codes into the respective fields on the landing page.

4. Click “View Next Step”

The site will verify your codes and pull up your pre-approved credit card offer.

5. Review the Offer Details

This includes:

- Credit Limit Range

- APR (Annual Percentage Rate)

- Fees (Annual Fee, Late Payment Fee, etc.)

- Reward structures (Cashback, Miles, Points)

6. Accept the Offer & Apply

If satisfied, proceed to submit your application. You may need to provide additional details such as income, housing status, and employment info.

7. Get an Instant Decision

Most applicants receive a decision in minutes. If approved, your new Capital One credit card will arrive by mail in 7-10 business days.

Where Can You Find Your Capital One Reservation and Access Codes?

The codes are provided only if you’ve been targeted by Capital One through its pre-qualification engine. Here’s where to check:

1. Paper Mail Offers

Look for a Capital One envelope addressed to you. The codes are typically printed in large bold text on the bottom portion.

2. Email Offers

If you’re registered with Capital One online services or newsletters, check your email inbox and spam folder.

3. Capital One Online Account

Existing Capital One customers can log into their dashboard and navigate to the “My Offers” section.

4. Call Customer Service

Dial 1-800-227-4825 and ask for help regarding a pre-approved offer. Provide your name, address, and SSN (last 4 digits).

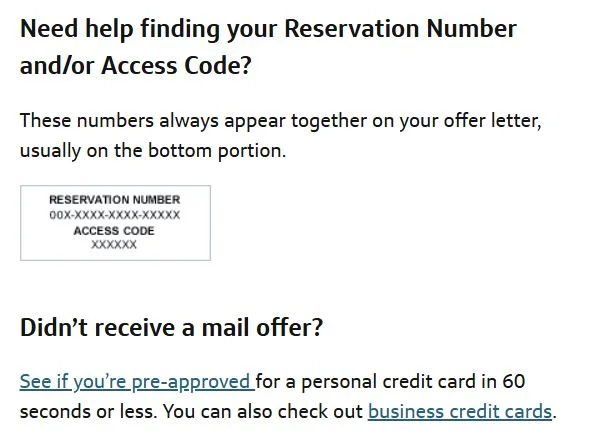

What if I Can’t Find my Reservation Number and/or Access Code?

If you can’t find your Reservation Number or Access Code, check the bottom section of your Capital One mail offer both numbers are printed together there. Didn’t get a mail offer? You can still check if you’re pre-approved online in 60 seconds or explore business credit card options.

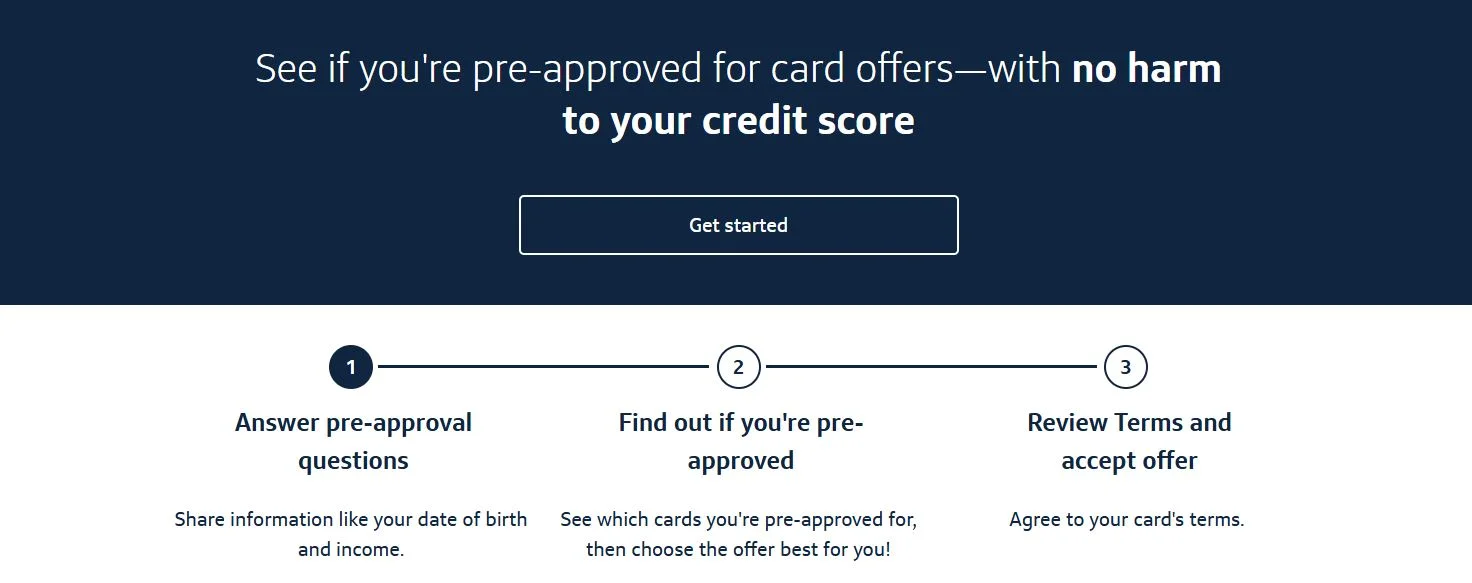

What If You Don’t Have a Code?

Not everyone receives a pre-approved offer. But you can still explore Capital One’s credit card options by using their pre-qualification tool:

Steps to Use Capital One Pre-Qualification Tool:

- Visit: https://www.capitalone.com/credit-cards/prequalify

- Enter your:

- Legal Name

- Address

- Date of Birth

- Last 4 digits of SSN

- Income

- Submit the form to view available offers

This is a soft credit inquiry and won’t affect your credit score. Once you find a card that suits you, proceed to apply.

Types of Capital One Credit Cards Available in 2025

Capital One offers a wide range of credit cards suited to different financial goals:

1. Cash Back Cards

- Capital One Quicksilver Cash Rewards

- Unlimited 1.5% cash back on all purchases

- No annual fee

- $200 bonus after spending $500 in 3 months

- Capital One SavorOne Cash Rewards

- 3% back on dining, entertainment, streaming

- No annual fee

2. Travel Rewards Cards

- Capital One Venture Rewards

- 2x miles on all purchases

- 75,000-mile bonus (after $4,000 spend in 3 months)

- Capital One Venture X

- Premium card with airport lounge access

- $395 annual fee but up to $1,000 in annual value

3. Rebuilding Credit

- Capital One Platinum Secured

- Initial deposit of $49–$200

- Helps build credit with responsible use

- Capital One QuicksilverOne

- Designed for fair credit

- 1.5% cash back, $39 annual fee

4. Student Credit Cards

- Journey Student Rewards

- 1% cashback (1.25% if payments made on time)

- No annual fee

How to Activate Your Capital One Credit Card?

Once your card arrives:

Online Activation:

- Visit: https://capitalone.com/activate

- Log into your account or create one

- Enter the 3-digit security code on the back of the card

Mobile App Activation:

- Download Capital One Mobile from the App Store or Google Play

- Log in and follow the activation prompt

Phone Activation:

- Call the toll-free number printed on the card sticker

- Follow the voice instructions and enter your details

How to Set Up Online Account Access?

Having online access allows you to:

- View transactions

- Pay bills

- Track rewards

- Set alerts

- Freeze/unfreeze card instantly

Steps:

- Visit: https://www.capitalone.com

- Click on “Set Up Online Access”

- Provide your:

- Name

- SSN/ITIN

- DOB

- Account Number (if available)

- Create a secure username and password

Security & Privacy at Getmyoffer.Capitalone.com

Capital One employs bank-grade security standards, including:

- HTTPS encryption for all data transfers

- Two-factor authentication

- Fraud detection algorithms

- Zero liability policy for unauthorized charges

Always confirm you’re visiting the official site. Look for the lock symbol next to the URL.

Expired or Invalid Code? What to Do

If your Capital One reservation or access code isn’t working:

- Double-check for typos

- Confirm the offer is still valid (codes expire in 30–60 days)

- Contact support to reissue or validate eligibility

Still having trouble? Use the pre-qualification tool to explore new offers.

Pre-Approval vs Pre-Qualification: What’s the Difference?

| Feature | Pre-Approval | Pre-Qualification |

| Credit Check | Soft Pull | Soft Pull |

| Based on | External credit report data | Consumer-submitted data |

| Guarantee Approval? | No, but high approval chance | Less certain |

| How Received | Mail or email offer | Manual submission |

Both are useful, but pre-approval is more predictive of actual approval.

Capital One Contact Information

If you have questions about your pre-approval or need support:

- Customer Service: 1-800-227-4825

- Lost Codes Help: Ask for pre-approval support

- Website: https://www.capitalone.com

Use Your Capital One Codes Wisely

Receiving a Capital One credit card offer through Getmyoffer.Capitalone.com means you’re being recognized as a qualified applicant. Whether your goal is to improve credit, earn travel rewards, or get cash back on groceries, using the reservation code and access code lets you bypass traditional obstacles and directly access high-value card offers.

It’s secure, quick, and optimized for your success in 2025. Don’t miss out offers are time-limited. Check your mailer, enter your code, and get approved today.

Need help comparing cards or creating a budget before applying? Let me know, and I’ll help you choose the best Capital One credit card for your financial goals.